The False Claims Act, or FCA, is one of the most powerful anti-fraud laws in the United States. Under the False Claims Act, average people who have information about fraud may be able to become whistleblowers. Whistleblowers who report fraud via the federal False Claims Act can be eligible to receive financial rewards as well as employment protections.

The False Claims Act protects and rewards whistleblowers, while disincentivizing scammers and con artists. The law applies to all those who make claims to the government in exchange for funding, whether they are businesses, non-profits, educational or research institutions, or even individuals.

If you have information about fraud or misleading claims made to obtain government funds, report it at once to the law firm of Tycko & Zavareei LLP. Our False Claims Act attorneys are among the top experts in anti-fraud law with the skills, resources, and experience necessary to protect your professional reputation and your interests. If you have specific questions about what you might need to report under the False Claims Act, our law firm is available today to answer any concerns or queries. Reporting fraud is the right thing to do—both for American taxpayers and for yourself.

What is the False Claims Act?

The False Claims Act is a civil anti-fraud law that holds those who violate it liable for up to treble damages (or three times the amount of money fraudulently obtained from the government). The amount of these penalties is assessed at rates that are linked to current inflation levels.

This civil law is commonly used to prosecute white collar financial crime, healthcare fraud, misleading pharmaceutical marketing, misuse of federal grants, and more. Any claim that involves federal funding may be eligible for False Claims Act reporting if the information reported back to the government agency is fraudulent, misleading, or incorrect.

False Claims Act Definition

Just as consumers have a right to truthful, non-deceptive, and evidence-backed advertisements with Truth in Advertising statutes, so too does the government have the right to truthful reporting within contracts and reimbursements. Whenever an exchange of taxpayer money is involved, it is important to know that the goods and services received in exchange actually occurred, and were of the promised caliber and quality. The False Claims Act helps remove businesses who engage in fraud from the pool of contractors, while ensuring that taxpayer funds are properly spent. The law also protects needy and vulnerable constituents who depend upon the services provided by government contractors, such as utilities, public safety, and healthcare.

False Claims Act History

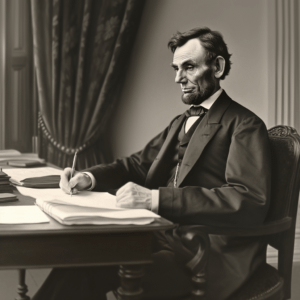

The False Claims Act was first passed by President Lincoln during the American Civil War in 1863. For this reason, the law is sometimes referred to as the “Lincoln Law.”

During the conflict, defense contractors were accused of bid-rigging, fixing their prices, and providing substandard products to the Union army. In order to combat fraud within military contracting, the False Claims Act was passed to hold companies liable if they reported false information about the quality of their goods and services.

Over time, the False Claims Act evolved to hold multiple areas of government contractors accountable. Penalties have been raised at different intervals throughout history, just as the role of the whistleblower has been further codified and protected.

Whistleblower law, such as the False Claims Act, is an area of qui tam law. Qui tam law allows citizens and non-citizens to pursue legal action on behalf of the government. If their case is successful, they may receive a percentage of the recovery. The concept evolved from England in the Middle Ages, and is named from a Latin phrase that translates into “he who acts on behalf of the King.” Under English law, the king enlisted the help of average people to help report violations of the law in promise of a reward. Today, whistleblowers report fraud under qui tam law in order to protect their own tax funds, as well as recover rewards.

False Claims Act Violations

The following are examples of False Claims Act violations. A False Claims Act whistleblower who has information about any of the following may be eligible to claim a reward:

1. Making false claims: False certifications to the government are illegal under the False Claims Act. Some common examples of false claims may involve misstating income levels to reduce tax liability, wrongfully making insurance claims, or misreporting credit scores when attempting to secure a government-backed loan.

2. Producing false statements or records: Producing false statements or records is prohibited under the False Claims Act, especially when attempting to secure a government contract. Common examples might include misrepresenting company qualifications or failing to report certain cybersecurity lapses.

3. Conspiracy: The conspiracy provision of the False Claims Act prohibits conspiring to defraud the government in any material way. This provision can be especially useful when it comes to holding larger groups accountable for fraud attempts or schemes. Anyone who is a party to the larger plan may be held jointly liable for the entire amount in the False Claims Act case.

4. Failure to return government property: Government property may be involved in cases involving contracting. Contractor inventory means any property acquired by or in use by a contractor or subcontractor to which the government holds the title.

5. False receipts: Providing false receipts is prohibited by the False Claims Act. Cases involving false receipts may involve insurance claims and receipts for services not rendered, or rendered only in part.

6. Unlawful purchase of government property: Unlawful purchase of government property and/or bribery may be involved in cases involving foreign officials and representatives.

7. Reverse false claims: Reverse False Claims Act concerns have been expanded since the passage of the Fraud Enhancement and Recovery Act (FERA) in 2009. Reverse false claims involve avoiding payments to the government, or knowingly concealing an obligation to pay or repay funds. Previously, only falsely filing or reporting claims could be covered under the FCA. FERA also expanded the concept of an “obligation” to the government, so that avoiding returning overpayments or shirking express or implied contractual obligations may also be prosecuted under the FCA.

Common Industries Involved in False Claims Act Cases

While the federal False Claims Act and qui tam litigation may be applied to almost any situation involving financial liability and the government, the following are certain industries commonly involved in False Claims Act cases:

Medical Industry

The following are areas of reportable healthcare fraud:

- Laboratory fraud

- Nursing home fraud

- Home healthcare fraud

- Medical billing fraud

- Private prison fraud

- Electronic health records fraud

- Medicare part C/Medicare advantage fraud

- Addiction treatment fraud

- Stark and anti-kickback fraud

- Seniors, veteran’s, hospitals, and pharmacy fraud

Maritime Shipping Industry

Evasions of customs and tariffs may be prosecuted under the Fraud Enhancement and Recovery Act, as well as other shipping-related statutes. The import of certain goods are subject to examination and fees. Unscrupulous shipping and logistics providers may attempt to circumvent paying their fair share in order to increase overall profits.

Defense Industry

Every year, the United States government spends about $1.64 trillion on defense and military resources. Unfortunately, defense contractors have attempted to defraud taxpayers and leave American service members under protected ever since the Civil War. The sale of diseased mules and defective muskets was what led President Lincoln to first pass the False Claims Act back in 1863.

Today, defense industry fraud may involve overpromising and underperforming on government contracts, false reporting on defense manufacturing, or not maintaining certain minimal safety and security standards while under contract with the Department of Defense or the federal government.

Financial Industry

Whistleblowers play a particularly important role when it comes to reporting securities fraud. Insider trading, cryptocurrency fraud, commodities fraud, mortgage scams, and other kinds of banking schemes are all common ways to take advantage of taxpayers. These kinds of banking and financial fraud can reverberate throughout the overall economy and take a toll, as they did during the 2008 financial crisis.

False Claim Act Penalties

A penalty is required for every violation of the False Claims Act, with liability up to three times the money obtained from the government. False Claim Act penalties range from $5,000-$10,000 per violation. Penalties imposed are also influenced by the state of the economy and are adjusted for inflation. At this time, the typical range per penalty would range from $12,537 – $25,076.

Penalties under False Claims Act Inflation Rates

- Before September 29, 1999: $5,000 – $10,000

- Between the dates of September 30, 1999 and November 2, 2015: $5,500 – $11,000

- Between the dates of November 3, 2015 and July 31, 2016: $5,500 – $11,000

- Between the dates of August 1, 2016 and February 2, 2017: $10,781 – $21,563

- Between the dates of February 3, 2017 and January 28, 2018: $10,957 – $21,916

- Between the dates of January 29, 2018 and June 18, 2020: $11,181 – $22,363

- Between the dates of June 19, 2020 and December 13, 2021: $11,665 – $23,331

- Between the dates of December 13, 2021 and May 9, 2022: $11,803 – $23,607

False Claims Act Whistleblower Rewards

Whistleblowers may receive up to 30% of the government’s overall recovery in a qui tam lawsuit involving the False Claims Act. Reward percentages may be increased in cases of particularly helpful information or cooperation from the whistleblower. They may also be reduced in event of whistleblower liability or complicity in the scheme. You do not have to be a citizen of the United States to receive a whistleblower reward.

Largest False Claims Act Settlements

Some whistleblower payouts involve settlements that number into the billions. These ongoing events of fraud can carry hefty rewards for whistleblowers who come forward to report them.

Some recent False Claims Act settlements that number into the billions include:

- GlaxoSmithKline – $3 billion

- Pfizer – $2.3 billion

- Johnson & Johnson – $2.2 billion

- HCA – $1.7 billion

- Abbott Labs – $1.5 billion

Are Whistleblowers Protected under the False Claims Act?

Whistleblowers are protected under the False Claims Act against discrimination, harassment, and retaliation by their employers. Some examples of prohibited retaliation include:

- Firing

- Demotion

- Reduction of pay

- Reduction of hours

- Changes to employment status

If you have been discriminated against by your employer after becoming a False Claims Act whistleblower, there may be legal recourse available. Whistleblowers may be able to sue their employer for double back pay, reinstatement, possible front pay, and legal fees in the event of a retaliation.

How to File a False Claims Act Case

False Claims Act cases may follow a variety of pathways depending on the facts of the claim. How you should proceed in a specific case should always depend upon a consultation with your False Claims Act lawyer. However, in general, filing a False Claims Act lawsuit may begin with:

- Collecting evidence: A whistleblower lawyer will be able to advise you on what kinds of evidence are admissible in a court of law. Documents like emails, texts, company reports, and more may all be useful in proving a fraud claim.

- File a qui tam complaint: With the help of your whistleblower law firm, you will be able to file a False Claims Act report. The government will have 60 days to review the material before the company or individual who has been accused of noncompliance is served.

- Offer to assist in any investigation: If the government chooses to investigate your claim, it is imperative that you offer any assistance possible as a whistleblower.

- Follow up on the claim: Some qui tam cases may be ongoing for months, if not years. Hiring the right qui tam law firm can help ensure that your claim does not get lost in the shuffle.

- Collect your whistleblower payout: You may be able to win up to 30% of the total settlement in the event of a successful lawsuit.

The False Claims Act: Establishing Knowledge

The False Claims Act does not involve criminal liability for fraud, only civil penalties. Additionally, anyone who unknowingly reports false information cannot be held liable under the False Claims Act. The law involves a knowledge requirement that states that the person or entity reporting “must have submitted, or caused the submission of the false claim (or made the false statement or record) with knowledge of the falsity.”

Under the False Claims Act “knowing” means acting with “(1) actual knowledge, (2) deliberate ignorance of the truth or falsity of the information, or (3) reckless disregard of the truth or falsity of the information.”

False Claims Act Statute of Limitations

Under Section 3731(b)(1) of the False Claims Act, a case must be brought within six years after the date of the alleged violation. Alternatively, an action may be brought no more than three years after the date when the facts of the case became known by, or should reasonably have been known by, the government official with responsibility to have addressed the situation. Finally, a case may be brought “no more than 10 years after the date on which the violation is committed.”

False Claims Act and Qui Tam Statistics

Whistleblowers play an important role in the operation of our government and federal programs. Here are a just a few statistics that underscore their importance:

- In Fiscal Year 2021, the Department of Justice used the False Claims Act to recover over $5.6 billion in settlements and judgements.

- About 80% of FCA lawsuits involve whistleblower intervention.

- The SEC has awarded approximately $1.2 billion to 249 whistleblowers since issuing its first award in 2012.

False Claims Act: FAQs

The following are some frequently asked questions regarding the False Claims Act and becoming a whistleblower:

1. When was the False Claims Act enacted?

The False Claims Act was first passed in 1863 during the American Civil War. The law originally was written to address defense contractor fraud, but has since expanded to include all government contracts and claims.

2. What happens after a whistleblower files a qui tam lawsuit under the False Claims Act?

After a whistleblower files a civil qui tam lawsuit under the False Claims Act, they may be contacted by the Department of Justice in order to investigate their claim. The Department of Justice has 60 days from the initial filing in order to decide whether or not to pursue a False Claims Act case before the defendant is served. If the government decides not to act on your allegations, the right False Claims Act attorney may still be able to represent you in your case for a possible whistleblower payout.

3. What is the difference between a civil and criminal False Claims Act?

The False Claims Act is a civil statute. While other anti-fraud statutes may include criminal liability, such as the Anti-Kickbacks Statute involving medical fraud, the False Claims Act only includes the risk of financial penalty.

4. What happens when a whistleblower is wrong?

Because of the extensive discovery process, a False Claims Act case is rarely pursued when a whistleblower is wrong. However, whistleblowers who made their disclosure in good faith continue to be protected under the FCA.

5. What is a reverse false claim?

A reverse false claim, as covered by FERA, is when a person or company purposefully avoids a payment or repayment to the government. Even if the party does not certify a false report to the government, if they take other steps to circumvent payment on an obligation to the government, this may be considered a reverse false claim.

6. How long does the average False Claims Act case take to resolve?

The average False Claims Act case may take months or even years to resolve. A False Claims Act attorney can be your relentless advocate during the resolution period. They can propel the case forwards during False Claims Act litigation, and ensure that you have every possible opportunity to be considered in a whistleblower payout.

7. Does the False Claims Act protect against whistleblower retaliation?

The U.S. False Claims Act offers powerful protection against employers who attempt to retaliate against whistleblower employees. Some possible recourses available via lawsuit include double back pay, front pay, and even reinstatement.

8. How much does it cost to file a qui tam lawsuit?

A qui tam law firm often takes a whistleblower case on contingency. This means that they cover all of the filing and legal fees associated with a qui tam claim. A whistleblower will be able to file their lawsuit without having to pay out-of-pocket costs for telling the truth.

9. Can False Claims Act whistleblowers remain anonymous?

False Claims Act whistleblowers can remain anonymous throughout most, if not all, stages of a legal complaint. Filing your lawsuit through a whistleblower law firm is a necessary step however. The law firm will be able to act in your name in order to keep your own identity sealed.

10. What should I look for in a whistleblower lawyer?

Whistleblower lawyers should be able to bring a level of professionalism, experience, and discretion to any qui tam case. The law office of Tycko & Zavareei LLP is made up of some of the top graduates of the best law schools in the United States, all with extensive experience in qui tam law and litigation practice. Our expertise has allowed us to act in some of the largest whistleblower cases heard to date.

When you are selecting a whistleblower lawyer to represent you, look for a law firm with the experience necessary to do your case justice, as well as the personal focus required to handle your case with discretion and care. Any whistleblower attorney must understand that their client’s anonymity and professional reputation are involved in their claim. The team at Tycko & Zavareei LLP are ready to treat every whistleblower who comes to us with the utmost respect and dedication. We are ready to bring our years of legal experience to bear to help ensure that justice is done, and your best interests are being looked out for.

Speak to a Whistleblower Lawyer Today to Make a False Claims Act Report

Fraud against the government is no simple matter. Federal and state False Claims Act statutes may be involved in any one claim. Company compliance, reporting, and investigative steps are usually involved, as well as bureaucratic government procedure. All of this must coalesce in order to file an official complaint against a company that will fight back to protect its profit motive, and superiors whose reputations may be at stake.

All the same, the truth must come out. The law firm of Tycko & Zavareei LLP can be by your side every step of the way to ensure that your claim has the best possible chance for success.

Whistleblowers protect both the taxpayer, as well as the citizens who depend upon government services. The False Claims Act is in place to help protect those who come forward, and reward them for their honesty. If you suspect you may be able to become a whistleblower, don’t wait. Speak to the law firm of Tycko & Zavareei LLP today.

2021 Update:

Congress has passed a Senate bill called the False Claims Act Amendments of 2021. The bill clarifies several provisions of the federal False Claims Act and even shifts the burden of proof onto the defendant in cases where they argue that, because it continued payments after being alerted to the fraud, the government did not suffer material losses.

The Supreme Court’s 2016 decision in United Health Services v. United States ex rel. Escobar, 136 S.Ct. 1989 confused courts by stating that the government’s conduct after a claim is submitted could be used as evidence to argue that the fraud was not material if no government action was taken. This decision has allowed fraudsters to argue that obvious fraud was not material simply because the government continued payment.

Additionally, the False Claims Act Amendments of 2021 now include post-employment retaliation in its whistleblower protections. These amendments affect all pending and future FCA claims.

2022 Update:

The fiscal year of 2022 had the second-highest number of False Claims Act settlements in history. Specifically, there were 351 settlements and judgments throughout 2022. Whistleblower claims during that time exceeded $2.2 billion, according to Principal Deputy Assistant Attorney General Brian M. Boynton. Since Congress fortified the False Claims Act in 1986, the amount of money recovered in successful qui tam claims now totals over $72 billion.